Narrative and Numbers

Narrative and Numbers, written by Mr. Aswath Damodaran, is basically based on connecting the storytellers with the numbers and argues that stories without numbers are just fairy tales and numbers without stories to back them up are exercises in financial modeling.

The author focuses on simplifying the process from stories to numbers (and vice-versa) to valuation to follow-up narratives and news.

He highlights the various tests for a credible business story and procedure to reach the destination and the iterative follow-up process.

He argues that the power of the story drives corporate value, adding substance to numbers and persuading even cautious investors to take risks.

Here are the few investing lessons and their applications in the Indian equity context:

1. Storytelling left unchecked can easily lose focus, and in the context of business stories, that can be dangerous for everyone involved.

Stories are extremely dangerous and powerful because they connect with people’s emotions, get remembered, and elicit action from listeners. Thus it is important to back up these stories with the numbers, which as act an antidote to these stories and help in reality checking with the facts.

For Example, take the story of Vinati Organics.You should that check it with the current market share that the company enjoys. Like in this case, Vinati Organics commands 60% market share in ATBS and 65% market share of IBB in the world.

“Those who listen to these stories should do so with open minds, always checking them against the facts and being willing to accept that, unlike fictional stories, business stories don’t always have the desired endings.

2. If your decisions are driven purely by numbers, then you are in big trouble due to two reasons, firstly your work can be easily replaced by machines and secondly it is easy to imitate your work.

Adding more realistic stories to your numbers will mitigate these problems, as storytelling is more nuanced, personal, and the numbers can be easily changed based on the change in your stories.

“When you are forced to unveil the story that backs your numbers, your biases are visible not just to the rest of the world but to yourself.”

3. Number crunching process is also full of biases much like storytelling, recognizing these biases will help in taking a more informed decision.

At each step of the number-crunching process, i.e. data collection to data analysis and to data presentation, you have to fight the urge to mold the data to fit your preconceptions.

“Your choices in what types of data you collect can affect the results you obtain, because your choices can create bias in your samples, often implicitly.”

For example, Selection Bias (a researcher who starts off intending to show that companies generally take good investments may decide to use only companies in the Nifty 50 or Next Nifty 50 in his sample, based on market capitalization).

The other challenge is the Survivor Bias (ignoring the portions of your universe that have been removed from your data for one reason or another). It will be a bigger issue with groups that have high failure rates, like for investors looking at young start-ups than for those looking at mature companies.

4. Our data analysis will be impacted by our biases, mainly the overuse of average “as we put too much trust in the average” and the outliers in the data and focusing only on the normal distribution.

A substantial portion of the investment decisions is based on the average, like comparing the company data with the sector average. “The average is not only a poor central measure on which to focus on distributions that are not symmetric, but it strikes me as a waste to not use the rest of the data.”

The problem with outliers is that they make your findings weaker. Removing outliers is a dangerous game; it opens the door to bias. “In fact, if you view your job in business and investing as dealing with crises, you can argue that it is the outliers you should be paying the most attention to, not the data that neatly fits your hypothesis.”

The most real-world phenomena are not normally distributed, and that is especially true for data we look at in business and finance. Despite that, analysts and researchers continue to use the normal distribution as their basis for making predictions and building models and are constantly surprised by outcomes that fall outside their ranges.

5. Before a business story is constructed, there is “homework” to be done by both storytellers and listeners. You have to review the business history, understand the market in which the company operates, and have a measure of what the competition looks like.

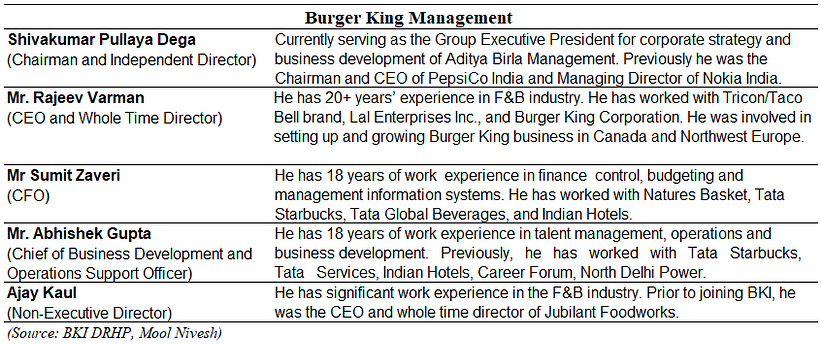

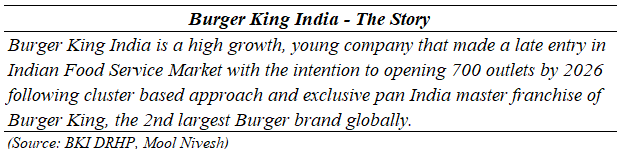

For an established business, you can start with past performance, growth, profitability, and business direction. With young companies, you may learn more as an investor by looking at the founders running the businesses and their histories and other more established companies in the same business. I have taken Burger King India as a case study.

Burger King India (BKI)— The Case StudyWithin just five years of entry in November 2014, it has established 261 restaurants in major cities and towns and become one of the fastest-growing international QSR chains in India. The company has exclusive rights to develop, establish, operate, and franchise Burger King branded restaurants in India as a master franchisee.

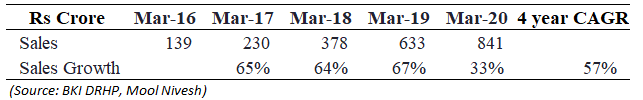

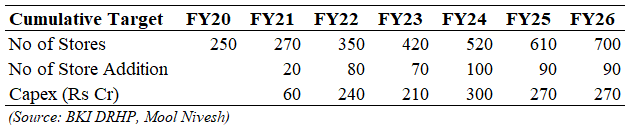

a. It is a high growth company: The company has been on a growth trajectory with a revenue (FY16-20) 4-years CAGR of 57% same-store sales grew at 12% and 29% in FY18 and FY19, respectively and a target to reach 700 stores by 2026 (originally the target was to meet till 2025, but due to covid-19, BKI has been able to renegotiate it to 2026).

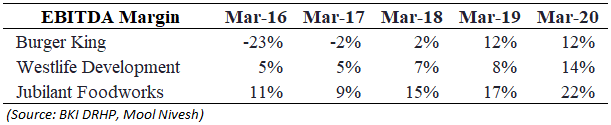

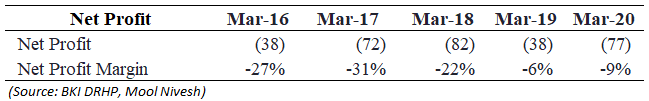

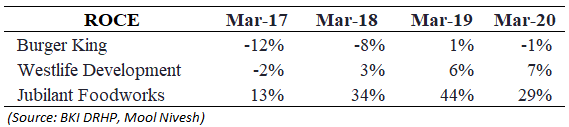

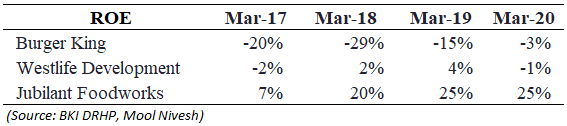

b. It has improved operating profit margins but they are yet to turn profitable (on a net profit basis) as lease payments, other fixed expenses have been eating up their margins.

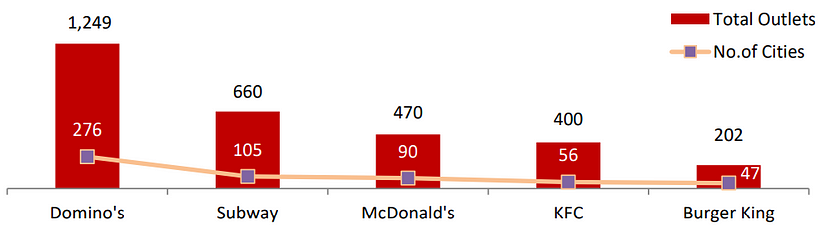

c. It has high reinvestment obligations of opening 700 outlets by 2026. Why 700 is such a big number for stores count? Have a look at its peers, the leading McDonald’s currently own 470 stores only with its first restaurant launch in India way back in 1996.

|

| (Source: BKI DRHP) |

Also, BK AsiaPac may terminate the Master franchise agreement if BKIL fails to achieve the cumulative opening target.

|

Cumulative Target of BKI Restaurants |

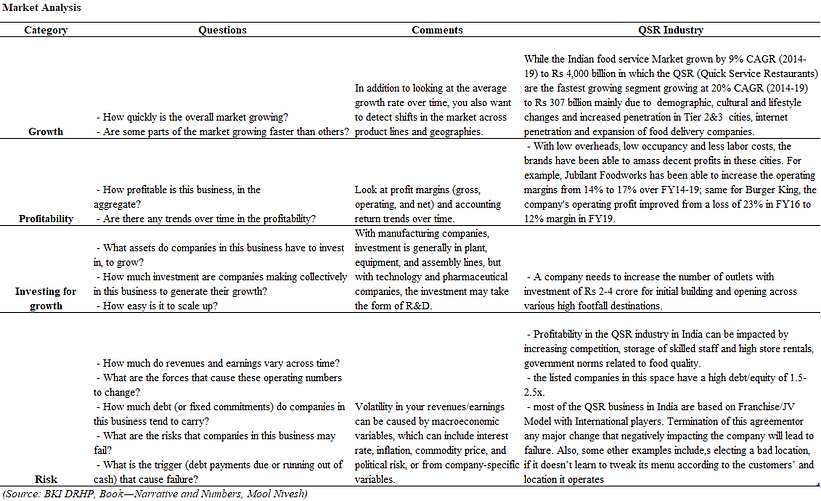

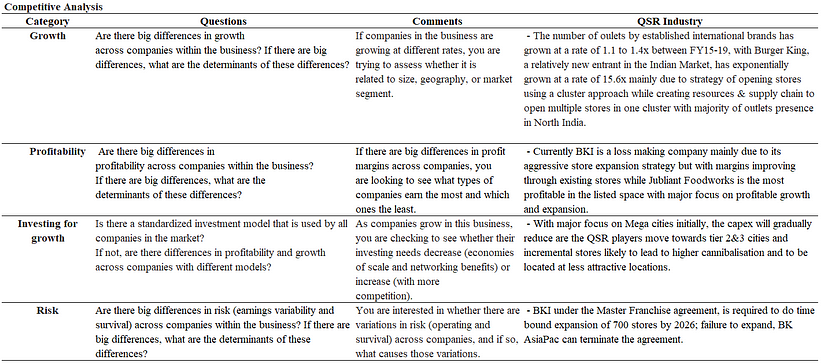

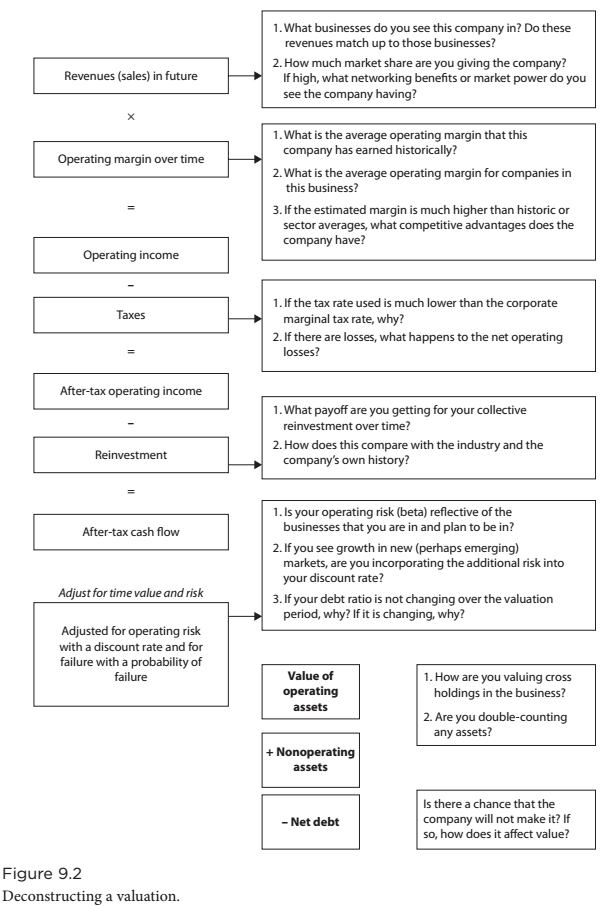

The second step is looking at the larger market in which the company is operating or plans to operate.

Here's a look at the market analysis for Burger King India:

After the pre-work, you are good-to-go for constructing the narrative. Since it is an iterative process, it is good to revisit the story as you run into any contradictory data.

“You are the storyteller, and that means you have to be willing to make judgments, which though based on data and information, are still judgments. You can and will be wrong, but that is not a reflection of your weaknesses but a consequence of uncertainty.”

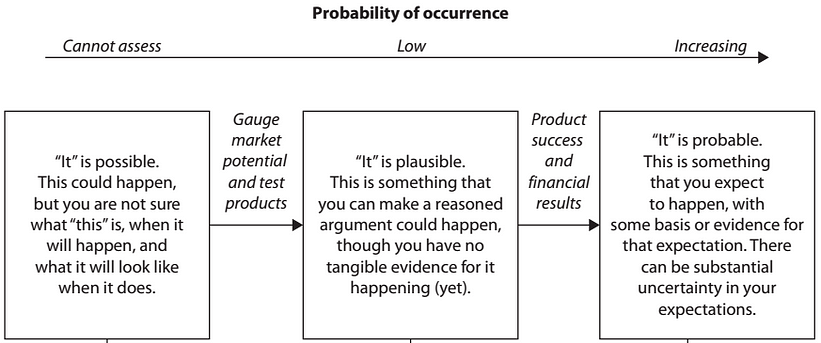

6. Once you have a story to tell, for the reality check you have to take 3 level tests (Possible-Plausible-Probable)

|

| 3Ps — Reality Checking for Stories |

The lines between the 3Ps - possible, plausible, and probable are not always easy to draw, but one simple and useful technique is to think about the distinction between impossible, implausible, and improbable.

The impossible stories are easy to identify; for example, a company cannot grow bigger than the economy or cannot achieve market share or operating profits of more than 100%.

Thus, it is a possible story that Burger King India is a young and high-growth company mainly focus on opening new stores irrespective of future losses, low same-store sales growth (SSSG).

Followed up with implausibility test, in which many stories get entangled, especially when they make assumptions about market dynamics, about how competitors, customers, employees, and regulators will behave in response to the actions of a company.

For Example, a company capturing a higher market share of a very competitive market. That is a plausible story, but not if you also claim that it will be able to simultaneously raise prices on its products and have higher profit margins.

It is implausible for BKI to increase the prices of its products and expecting to gain some market share as it is in a highly competitive market.

Then, what would be the plausible story? How BKI will turn profitable? It’s simple!! through operating leverage. As the company increases the store reach, networking benefits will reward through margin improvement. but in the near term, there will be some setbacks due to people hesitant to eating out due to the pandemic Covid-19.

However, it is a great time for store expansion due to favorable long-term leasing and can operationalize mainly through delivery-only outlets.

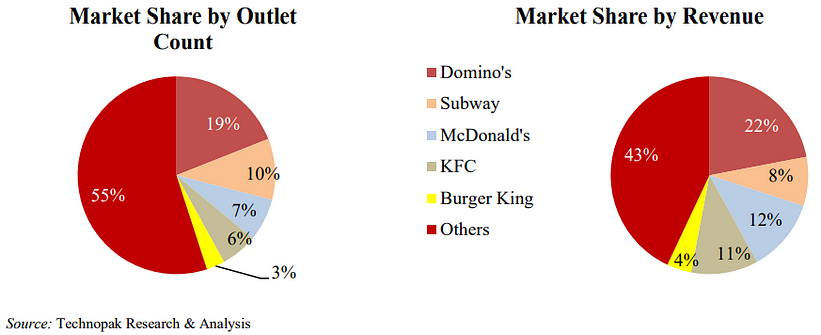

|

| Market Share — Indian Chain QSR Space |

“With almost every part of your narrative, you have to think through how others will react and whether your results will continue to hold, given their reactions.”

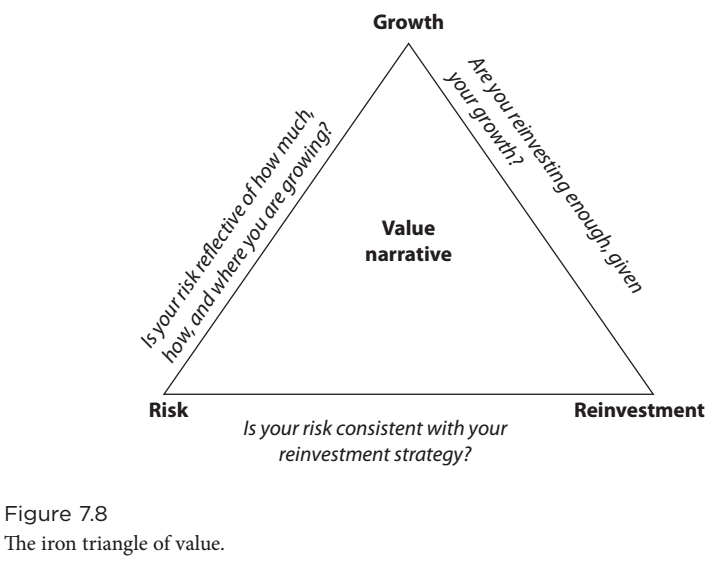

There are 3 main value drivers, namely, growth, risk, and reinvestment (Author named it as Iron Triangle of Value). For the stories to become improbable - the end test, are the internal inconsistencies in these parameters, where each piece of the story makes sense but the overall story does not.

For example, a company with high growth will generally need to have high reinvestment to deliver that growth, and it will be riskier than average much of the time. Thus, a story that combines high growth with low risk and low reinvestment, is usually improbable because it is inconsistent.

So, our story of BKI passes all the 3P tests for a credible narrative.

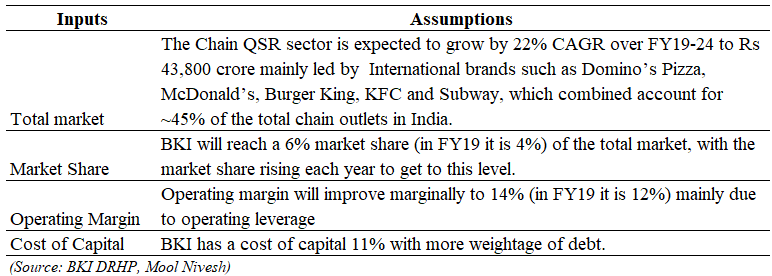

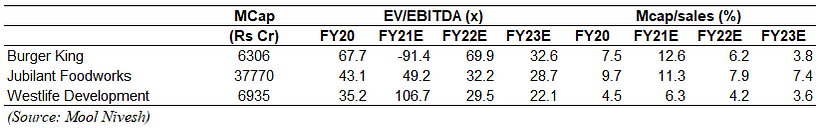

7. Connecting Stories to Valuation Input can be easy if you have a versatile framework based on the valuation model.

Here is an example of the journey of computing the business value from the story:

|

| Stories to Numbers |

|

| Valuation Inputs |

The process is not always sequential, and it is entirely possible that as you attach valuation inputs to your story, you may feel the need to revisit earlier parts of the story and tweak or change them and it will make your stories stronger and your valuations more credible.

Rather than get lost in the details of the valuation model, though, you will be better served if you use your narrative to decide the specifics on which you want to spend the most time and resources.

“It is worth emphasizing here that the inputs are interconnected, that is, changes in one almost always trigger changes in the others.”

So, there arises a question, that can we reverse the process, i.e., from valuations to generate stories? Yes, and there are reasons that you might want to do so. First, once you extract stories from numbers, you can access whether the story is comfortable and the second one is testing the person who is doing the valuations, whether an analyst is mechanically plugging numbers into models or has a serious story. Here is an example of some questions:

|

| Numbers to Stories |

You need to bring both stories and numbers into play in investing and business and valuation is the bridge between the two. It allows each side to draw on the other, forcing storytellers to see the parts of their stories that are improbable or implausible and to fix them, and number crunchers to recognize when their numbers generate a storyline that does not make sense or is not credible.

|

| Valuation Bridge |

“A valuation that is not backed up by a story is both soulless and untrustworthy and that we remember stories better than spreadsheets.”

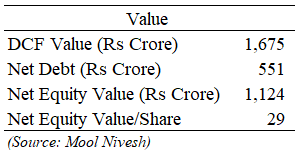

Below is the Valuation Result of the above exercise for BKI and pricing comparison with peers:

|

| DCF Valuation |

|

| Peer Comparison |

Price Vs Value: As per Mr. Damodaran, people who based their valuation on pricing models are more of a trader or to be specific, speculators, as it is a reflection of shallow analysis. The pricing method has many weaknesses like it is just an intermediate step to valuation, the market is fickle, i.e., the market suddenly shifts its attention from one variable to an entirely different one across the corporate life cycle, and by looking as investors interest on a metric, companies also start to drive their narrative towards that metrics which can change the story entirely.

“The push and pull of the market (momentums, fads, and other pricing forces) and liquidity (or the lack thereof) can cause prices to have a dynamic entirely their own, which can lead to the market price being different from value.”

Terminal Value plays a significant contributor to the value; sometimes 60–100% of the value depends on the terminal value.

Rather than view it as a weakness of the model, as some are apt to do, consider it a reflection of how you make money as an equity investor in a business.

Equity investors generate cash flows while they hold onto their investments in the form of dividends or cash payouts, but the bulk of their returns comes from price appreciation.

The terminal value stands in for this price appreciation, and not surprisingly, as the growth potential of a business increases, the terminal value’s contribution to current value will also increase.

It still remains up to you to decide how I respond to that feedback, but being open to changing your narrative is not a sign of weakness but of strength.

Some points help in getting more feedbacks like making your narrative and valuation transparent, separate the constructive criticism from the noise, look for the parts where you got the most negative feedbacks and disagreements (it is a signal that you have either not been clear about explaining the reasoning or, worse, that you have not fully thought through that part of the story) and lastly think about the process and not the end product, the interesting and the learning part is the journey.

“There is one final cautionary note that I should add. Listening to others does not require capitulation. I have heard well-reasoned arguments about why a part of my narrative is wrong and have chosen to not make changes to it because it is still my judgment to make.”

In this information age, we got updated with regular news related to the companies which can dramatically alter our narratives. You can classify these narrative alterations into breaks, changes, and shifts, and the resulting effects on value.

Narrative breaks represent an end to a story that might have had promise at some stage, but no more. For example, natural or manmade disaster, legal/regulatory action, failure to make contractual payments, etc.

Narrative changes make significant modifications to the story that you have for a company, and with those changes can come large changes in value. These changes can come from different sources and have positive or negative effects, but one way to organize them is to use the narrative framework.

|

| The Narrative Framework for Changing Stories |

Narrative shifts are much smaller alterations that nevertheless will show up as increases or decreases in value.

“Admitting you were wrong on a narrative (and the resulting value) is never easy, but it gets easier each time you do it. Who knows? One day, you may actually enjoy admitting your mistakes!”

If you are an investor, uninterested in playing the pricing game, and more concerned with value, you should look at earnings reports very differently than traders would. Rather than focus on whether the reported earnings per share meet or beat expectations, you should scan these reports for information that could change your narrative about the company and its value.

Apart from earning announcement, almost all corporate announcements of consequence can be categorized into news about investments (adding new assets, divesting old ones, or updating existing ones), financing (raising new financing or paying down old financing), and dividends (decreasing or increasing cash returned to investors in dividends or buybacks).

The news related to the corporate scandals and misconducts can also lead to change in your story and value as the scandal can unalterably change the reputation of the company, key components of the business model may have been built on questionable business practices and it often results in management turnover, with the new management perhaps bringing a different perspective to the company.

“The market reaction to these announcements is more of a pricing game, and it is conceivable that a news story can cause large price changes without much change in value or large value changes with little price effect. To the extent that top managers in the company play a role in setting its narrative, news that is about them will also affect both value and price.”

So, we have got to learn many things from this book, mainly the framework, the importance of both the story and the number; focus on credible stories backed by numbers, and finally keep your valuations updated.

And lastly one final word of wisdom from the Author:

“The future of investing belongs to those who are flexible in their thinking and capable of moving easily from one segment of the market to another.”

For more such book summaries backed by real-life case studies, more detailed company analysis, subscribe to Mool Nivesh.

What are you waiting for!!!

It's Free...Free...Free...

Subscribe Now and make yourself a learning machine... learning new things...thinking out of the box....acting on the learnings.....invest in yourself.

Comments

Post a Comment